Home equity is the value of your home that you actually own, after subtracting any remaining debt from your mortgage. Calculating your home equity accurately helps you understand your financial situation, as well as your future financial opportunities. However, insurance plays an extremely important role in building and protecting home equitys. Insurance can help protect the value of your property from unexpected risks, and is an essential part of maintaining and increasing home equity. In this article, we will explore how to calculate home equitys and how insurance can help you in this process.

1. DEFINITION OF HOME EQUITY

Home equity, also known as home equity, is the difference between the market value of your home and the amount you still owe on your mortgage. For example, if your home is worth $500,000 and you owe $300,000, your home equity is $200,000. This means you have paid off a large portion of the home and own the remainder.

Insurance plays an important role in protecting your home equitys. Without insurance, you could lose most or all of your home equity in the event of a fire, natural disaster, or theft. Therefore, having adequate insurance coverage is essential to protect your assets and maintain the home equitys you have built up.

2. HOW TO CALCULATE HOME EQUITY

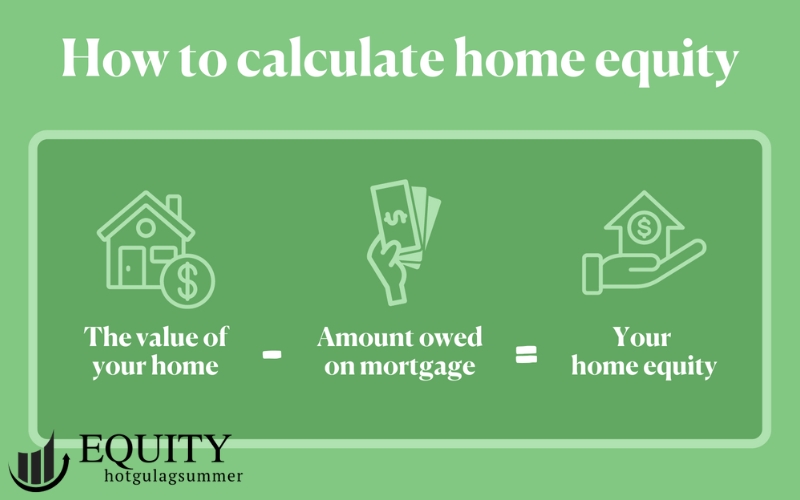

To calculate home equitys, you need to know the market value of your home and the remaining mortgage debt. The formula for calculating home equity is:

Home Equity = Market Value of Home – Remaining Mortgage Debt.

The market value of your home is the amount you can sell your home for in the current market, based on factors such as location, size, condition, and the selling price of similar homes in the area. Meanwhile, the mortgage balance is the amount of money you still owe to a bank or financial institution. As you pay off your mortgage, your home equity increases.

An important factor in calculating home equitys is insurance. If you do not have adequate home insurance, the value of your home may decrease if an accident occurs. In this case, your home equitys will also be affected. Therefore, insurance helps you protect the value of your home and the equity you have accumulated.

3. THE IMPACT OF INSURANCE ON HOME EQUITY

Home insurance has a direct impact on calculating and maintaining home equitys. When you have home insurance, it helps protect your property from unexpected risks such as natural disasters, fires, or incidents that can reduce the value of your home. This can help you maintain and even increase your home equitys.

If you experience an incident that causes serious damage to your home, insurance will help you repair or compensate for the damage, helping you avoid losing a portion of your accumulated home equity. Without insurance, you may be left with the full financial loss if your home is damaged or lost, significantly reducing your home equitys.

For example, if your home burns down and you don’t have insurance, you will be responsible for repairing all the damage out of your own pocket. Whereas, if you have insurance, you only need to pay a small premium and the insurance will take care of the rest, protecting the value of your home and helping you maintain your home equity.

4. TYPES OF HOME INSURANCE

There are many types of insurance that can help you protect your home equitys, including:

Homeowners Insurance: This is a basic type of insurance that protects your home from risks such as fire, natural disasters, theft, and other incidents. This insurance will help you protect your assets and ensure that you do not lose a large portion of your home equitys if your home is damaged.

Property Insurance: This type of insurance helps protect your home from incidents that cause property damage, such as earthquakes or snowstorms. Without insurance, you may have to pay for repairs and replacement of lost property, which will affect your home equitys.

Mortgage Insurance: This insurance helps protect your mortgage in case you are unable to make payments. While this type of insurance does not directly protect your home equity, it does help you avoid losing your property if you are unable to continue making payments due to unforeseen factors.

Liability Insurance: This type of insurance protects you from legal liability if someone is injured in your home or if you cause damage to someone else’s property. This type of insurance does not directly affect the value of your home, but it helps protect your personal finances from the costs associated with liability.

5. INSURANCE AND THE LONG-TERM BENEFITS OF HOME OWNERSHIP

Insurance helps maintain the value of your home and protects your home equity from unexpected risks. Once you have built up a significant amount of home equitys, insurance helps you maintain and increase the value of this asset over time. Without insurance, unexpected risks can cause significant financial loss and affect your ability to repay loans or increase your home equitys.

In addition, insurance can also help you avoid urgent financial problems, such as home repairs after an accident. This helps you continue to maintain and develop your assets without facing major financial burdens.

CONCLUSION

How to calculate home equity is an important factor to help you understand your financial situation. However, to protect and maintain this home equitys, insurance plays an indispensable role. Insurance not only helps you protect your assets from risks but also helps you maintain the value of your home equitys in the long term. Therefore, combining insurance with building home equity is a smart financial strategy, helping you achieve financial stability and protect your assets from unwanted risks.